Home Renovation Loan – Finance Home Renovating Expenses

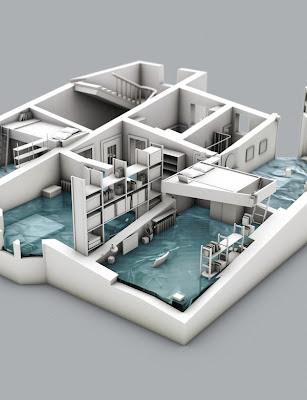

Most individuals typically wish to get a hand on new beautiful and eye-catching house once in lifetime. Once they manage to materialize the dream house, there comes consideration of renovation especially followed by month’s long stay in the house.

Undoubtedly, an experience of requirement related to home improvement or renovation follows when the entire ambiance of the house looks gloomy and untidy, defining absolute imperfection for comfy accommodation.

At such time of home renovation necessity, an individual is not oblivious the prospective expenses as well. This is the reason why home loan as a form of home improvement loan could be of great assistance in needs.

Home improvement/renovation loan is recognized as one of the best and most trustworthy loans to help you materialize expenses. The quantum of finance that one avails is considerably large enough to foot your expenses like flooring, tilling, internal and external painting, roofing and waterproofing and electrical work and plumbing and many more expenses can be mitigated through this home loans.

Considering that the overall expenses warrant large number of financial assistance, with having housing finance in hands, one can easily sort out expenses to a greater extent.

As said before, home improvement loan is one of the forms of home loan that’s designed to render you sufficient finance against expenses pertaining to safely accomplishment of the renovation works.

With having so many banks and housing finance companies in market today, acquisition of such finance is not a difficult task at all.

You can get such finance from any one of the financial institutes located in the vicinity of your resident. Banks having unblemished market reputation of providing home improvement finance include hdfc bank, state bank of India, axis bank and others.

Therefore, you can make an approach to acquiring the finance to one of these leading institutes. Moreover, they are also distinguished for offering affordable home loans to help you meet expenses of home renovation.

As much as 85% of loan will be allowed for the tenure of 25 years as home improvement loan. Some charges like prepayment and late payment would follow with the finance. Processing fees are non-refundable and mandatory payable amount during application for the loan.

In addition, compliance with home loan eligibility requirements of lenders is must to get a hand on the finance. Proper consideration of home loan interest rate will lend gravity of importance on your financial needs.

Therefore, consideration of these factors beforehand can help you facilitate acquisition of home improvement loan.

Home improvement or home renovation loan is one of the most reliable loans against expenses related to home improvement. You will be financed greatly for large repayment duration of course.

Undoubtedly, an experience of requirement related to home improvement or renovation follows when the entire ambiance of the house looks gloomy and untidy, defining absolute imperfection for comfy accommodation.

At such time of home renovation necessity, an individual is not oblivious the prospective expenses as well. This is the reason why home loan as a form of home improvement loan could be of great assistance in needs.

Home improvement/renovation loan is recognized as one of the best and most trustworthy loans to help you materialize expenses. The quantum of finance that one avails is considerably large enough to foot your expenses like flooring, tilling, internal and external painting, roofing and waterproofing and electrical work and plumbing and many more expenses can be mitigated through this home loans.

Considering that the overall expenses warrant large number of financial assistance, with having housing finance in hands, one can easily sort out expenses to a greater extent.

As said before, home improvement loan is one of the forms of home loan that’s designed to render you sufficient finance against expenses pertaining to safely accomplishment of the renovation works.

With having so many banks and housing finance companies in market today, acquisition of such finance is not a difficult task at all.

You can get such finance from any one of the financial institutes located in the vicinity of your resident. Banks having unblemished market reputation of providing home improvement finance include hdfc bank, state bank of India, axis bank and others.

Therefore, you can make an approach to acquiring the finance to one of these leading institutes. Moreover, they are also distinguished for offering affordable home loans to help you meet expenses of home renovation.

As much as 85% of loan will be allowed for the tenure of 25 years as home improvement loan. Some charges like prepayment and late payment would follow with the finance. Processing fees are non-refundable and mandatory payable amount during application for the loan.

In addition, compliance with home loan eligibility requirements of lenders is must to get a hand on the finance. Proper consideration of home loan interest rate will lend gravity of importance on your financial needs.

Therefore, consideration of these factors beforehand can help you facilitate acquisition of home improvement loan.

Home improvement or home renovation loan is one of the most reliable loans against expenses related to home improvement. You will be financed greatly for large repayment duration of course.

Comments

fasadrenovering

Same Day Payday Loans

Click here!